Companies must constantly manage risks in their everyday workings. Unexpected disruptions can cause significant damage, both financially and operationally. To avoid this, organizations need to monitor risks regularly. This helps identify potential threats early, allowing them to take proactive measures.

- The Five Steps of Risk Management

- Proactive Risk Identification for Early Detection

- Minimizing Business Vulnerabilities Through Continuous Analysis

- Understanding the Impact of Emerging Threats

- Prioritizing Risks to Safeguard Critical Operations

- Developing Actionable Risk Treatment Plans

- Enhancing Decision-Making with Real-Time Risk Monitoring

- Avoiding Financial Losses Through Strategic Risk Management

- Maintaining Compliance with Regulatory Requirements

- Mitigating Operational Disruptions with Consistent Oversight

- How a Risk Compliance Platform Can Help

Companies that fail to do so often face unexpected downtime, loss of revenue, or harm to their reputation. Regular monitoring of risks and knowing things like the 5 steps of risk management not only ensures business continuity but also builds long-term resilience. In this article, however, you will find out what those five steps are, how monitoring of risks can help avoid these disruptions and what processes are essential for success.

The Five Steps of Risk Management

Effective risk management involves a structured approach. Here are the five essential steps:

- Risk Identification: Businesses must first identify potential risks. This could involve analyzing internal processes, market conditions, or external factors that could threaten operations.

- Risk Analysis: Once identified, companies need to assess the potential impact of each risk. This helps determine which risks are most likely to disrupt operations and which ones require immediate attention.

- Risk Prioritization: After analysis, organizations must prioritize risks based on their severity. This ensures that resources are directed toward addressing the most critical risks first.

- Risk Treatment: With priorities set, companies develop strategies to treat or mitigate the risks. This could involve implementing preventative measures, creating contingency plans, or outsourcing risk management tasks.

- Risk Monitoring: Finally, regular monitoring ensures that companies stay on top of their risk landscape. Continuous oversight allows businesses to adapt and update their strategies as new risks emerge or existing ones evolve.

These steps provide a solid foundation for managing risks effectively. By following this process, businesses can reduce the likelihood of disruptions and maintain smooth operations even in uncertain times.

Proactive Risk Identification for Early Detection

Risks can come from anywhere—internal operations, market changes, or external threats. Regular risk monitoring allows businesses to identify these risks before they escalate. By detecting them early, companies can create strategies to handle them before they turn into a full-blown crisis. Whether it’s a financial risk or an operational challenge, early detection provides a crucial window to act before any significant damage occurs.

Minimizing Business Vulnerabilities Through Continuous Analysis

Many businesses have weak points that are not obvious until a crisis happens. Monitoring consistently allows companies to uncover hidden vulnerabilities that might otherwise go unnoticed. Utilizing advanced risk management software can streamline this process, providing real-time insights and proactive risk identification to strengthen business resilience. Businesses that continuously analyze their risk landscape remain more stable and less prone to sudden breakdowns.

Understanding the Impact of Emerging Threats

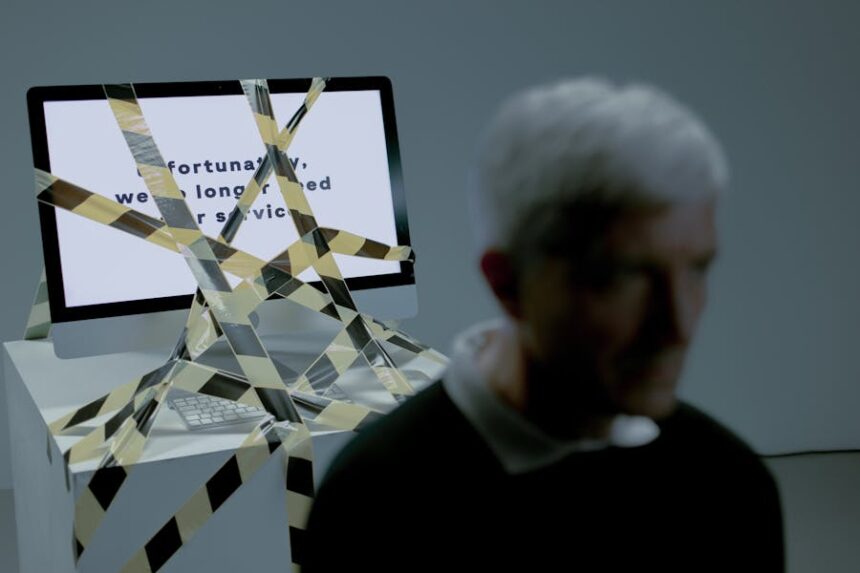

The world of business is ever-changing. New threats, such as cybersecurity risks or global supply chain disruptions, can emerge at any time. Continuous monitoring helps businesses stay informed about new threats that could affect them. When a company is aware of these emerging risks, it can adapt and pivot quickly. By understanding how new risks could impact operations, leadership teams can adjust their strategies accordingly, ensuring they remain on top of any changes.

Prioritizing Risks to Safeguard Critical Operations

Not all risks carry the same weight. Some risks can cripple a business if left unchecked, while others are more manageable. Regular monitoring helps businesses prioritize risks based on their potential impact. By doing so, organizations can allocate resources where they are most needed, focusing on safeguarding critical operations. It’s about knowing where to focus energy and attention, ensuring the most important areas remain protected even during challenging times.

Developing Actionable Risk Treatment Plans

Identifying risks is one thing, but having a plan to handle them is even more important. Regular risk monitoring ensures that businesses don’t just detect risks—they also develop actionable treatment plans. Whether it’s creating contingency plans for operational disruptions or financial safeguards, having a clear action plan lets businesses respond quickly and effectively to any risk that emerges. These treatment plans are crucial to mitigating risk impact and maintaining business continuity.

Enhancing Decision-Making with Real-Time Risk Monitoring

Decisions are the backbone of every organization. Making the right decision at the right time can prevent major business disruptions. With real-time risk monitoring, companies gain insights into their current risk landscape, allowing them to make more informed decisions. Access to up-to-date information ensures that leadership teams can act swiftly and with confidence. Real-time monitoring offers the agility businesses need to stay competitive and secure.

Avoiding Financial Losses Through Strategic Risk Management

Financial stability is a top priority for every organization. Unexpected disruptions often lead to financial losses, which can be severe. By regularly monitoring risks, companies can prevent these losses by addressing potential financial pitfalls early on. This helps businesses avoid expensive mistakes, unnecessary costs, and other financial strains. In the long run, strategic risk management protects the bottom line, keeping the company financially healthy and sustainable.

Maintaining Compliance with Regulatory Requirements

Regulatory compliance is crucial for many industries. Non compliance leads to fines, legal issues, and damage to a company’s reputation. Regular monitoring helps businesses stay on top of compliance requirements, ensuring they meet all legal standards. This prevents regulatory breaches that could disrupt business operations. A proactive approach to monitoring risks related to compliance is key to avoiding unnecessary disruptions due to regulatory non-compliance.

Mitigating Operational Disruptions with Consistent Oversight

Operational disruptions can happen at any time, whether through supply chain issues, equipment failures, or staffing problems. Regular risk oversight ensures that businesses can anticipate these disruptions before they occur. By keeping a close eye on the risk factors affecting operations, companies can implement preventative measures to ensure that their day-to-day activities run smoothly. This kind of consistent oversight is essential for keeping operations stable, even in challenging circumstances.

How a Risk Compliance Platform Can Help

A risk compliance platform can simplify the complex process of risk monitoring. These platforms automate risk identification, tracking, and reporting, giving businesses a clear view of their current risk landscape. With the help of a platform, companies can manage risks more efficiently, ensuring they meet compliance requirements without wasting time on manual processes.

The platform provides real-time updates and analytics, helping leadership teams make better decisions based on accurate data. Investing in such a tool ensures that risks are managed effectively, saving time and reducing the likelihood of unexpected disruptions.

Regular monitoring, knowing 5 steps of risk management and other crucial aspects related to it is essential for keeping businesses safe from unexpected disruptions. It helps organizations stay aware of potential threats, prioritize their responses, and maintain operational stability.