For small businesses in Denver, accurate bookkeeping is more than just a financial task—it’s a critical component of your overall business strategy. The meticulous management of financial records not only ensures compliance with regulations but also provides valuable insights into your business’s health and performance. In an environment where every decision counts, having precise and organized financial data is indispensable.

Effective bookkeeping can be the difference between thriving and struggling. For many small business owners, the choice between handling bookkeeping internally or outsourcing to professional accounting and bookkeeping services is a significant one. This article explores why accurate bookkeeping is crucial and how leveraging expert services can streamline your operations and contribute to your success.

Understanding the Role of Bookkeeping

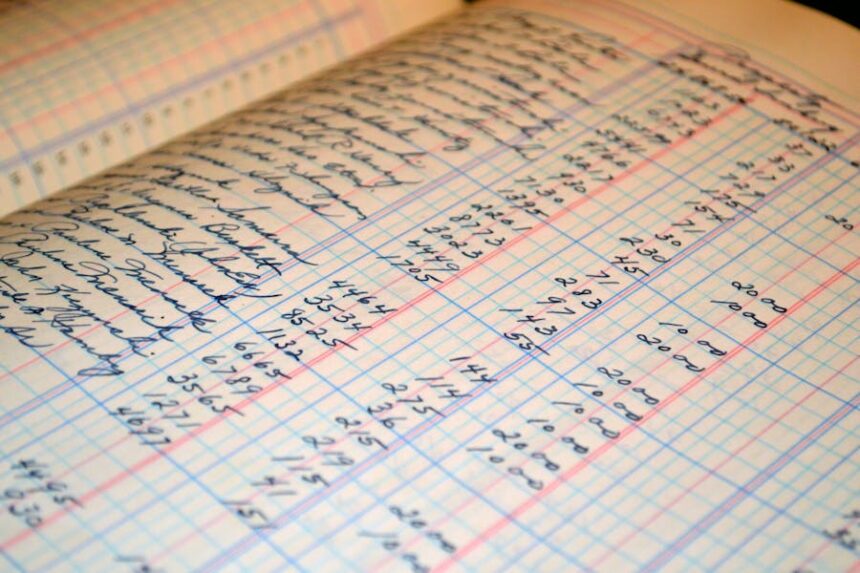

Bookkeeping involves recording, classifying, and summarizing financial transactions. This process is essential for maintaining accurate financial statements, including income statements, balance sheets, and cash flow statements. For small businesses, diligent bookkeeping helps track revenue, expenses, and profitability, which are key to making informed decisions.

Accurate bookkeeping ensures that all financial data is up-to-date and error-free, allowing business owners to focus on strategic planning and growth. Without proper bookkeeping, businesses risk facing financial discrepancies, missed tax deadlines, and potential legal issues.

Benefits of Accurate Bookkeeping

- Enhanced Financial Insights: Accurate bookkeeping provides clear insights into your business’s financial health. Regularly updated records help you understand cash flow, profitability, and financial trends, allowing you to make data-driven decisions. This clarity can be crucial for budgeting, forecasting, and identifying areas for improvement.

- Tax Compliance: One of the primary benefits of maintaining accurate books is ensuring compliance with tax regulations. Proper documentation simplifies the process of filing taxes, minimizes the risk of errors, and helps avoid penalties. Whether you handle taxes yourself or rely on a professional, accurate records make tax season much less stressful.

- Improved Cash Flow Management: Effective bookkeeping helps manage your cash flow by keeping track of accounts receivable and payable. With accurate records, you can promptly follow up on outstanding invoices and plan for upcoming expenses, ensuring that your business remains financially stable.

- Facilitated Business Growth: As your business grows, having a solid bookkeeping foundation allows for smoother scaling. Accurate financial records make it easier to secure loans, attract investors, and evaluate the impact of growth initiatives. Investors and lenders often look for well-maintained financial records as a sign of a reliable and viable business.

- Streamlined Financial Reporting: Regular and accurate bookkeeping enables timely financial reporting, which is essential for monitoring business performance and making informed decisions. Financial reports generated from accurate books provide a snapshot of your business’s status and help track progress toward financial goals.

Choosing Between In-House and Outsourced Bookkeeping

Small business owners often face the decision of whether to manage bookkeeping in-house or outsource it to professionals. Each approach has its advantages and potential drawbacks.

- In-House Bookkeeping: Managing bookkeeping internally allows for greater control over financial data and processes. It can be a good option if you have a dedicated employee with accounting expertise. However, it may require investing in accounting software and ongoing training to stay current with best practices and regulations.

- Outsourcing Bookkeeping: Many small businesses opt for bookkeeping online services to benefit from professional expertise without the overhead of a full-time employee. Outsourcing to a professional service provides access to experienced accountants, advanced tools, and up-to-date knowledge of tax laws and accounting standards. This can be particularly valuable for businesses that lack the resources to hire a full-time accountant.

Key Considerations for Choosing a Bookkeeping Service

When selecting a bookkeeping service, whether online or in-person, consider the following factors:

- Experience and Expertise: Look for a service with a proven track record in handling bookkeeping for small businesses. They should have experience with financial reporting, tax compliance, and industry-specific requirements.

- Range of Services: Choose a service that offers comprehensive bookkeeping solutions, including financial statement preparation, tax filing assistance, and ongoing financial analysis. The more services provided, the more you can rely on them for complete financial management.

- Technology and Tools: Ensure that the bookkeeping service uses reliable and secure technology. Modern accounting software can streamline processes, enhance accuracy, and provide real-time access to financial data.

- Customer Support: Good customer support is essential for addressing any issues or questions that may arise. Ensure that the service offers responsive support and clear communication.

- Cost and Value: Compare the costs of different services and evaluate them against the value they provide. While cost is an important consideration, the quality and comprehensiveness of the services should be prioritized to ensure long-term benefits.

Conclusion

Accurate bookkeeping is a cornerstone of effective financial management for small businesses. Whether you choose to handle it in-house or enlist the help of accounting and bookkeeping services, maintaining precise records is crucial for managing cash flow, ensuring tax compliance, and supporting business growth.

In Denver, where businesses are continually evolving and facing new challenges, having a reliable bookkeeping system in place can make a significant difference in achieving financial stability and success. By prioritizing accurate bookkeeping, you’re not just managing your finances—you’re setting the stage for a prosperous future.

Recommended SEO Title:

“The Importance of Accurate Bookkeeping for Small Businesses in Denver | Essential Financial Management”

Recommended Meta Description:

“Discover why accurate bookkeeping is vital for small businesses in Denver. Learn about the benefits, key considerations, and how professional bookkeeping services can ensure financial success.”

Recommended Featured Snippet:

“Accurate bookkeeping is essential for small businesses, providing enhanced financial insights, ensuring tax compliance, and improving cash flow management. Discover how maintaining precise records supports business growth and facilitates better decision-making.”