The exchange rate of the dollar to the Philippine peso plays a crucial role in the economy, impacting not only businesses but also individuals engaged in trade, travel, or remittances. As of today, the dollar trades at a significant level against the peso, reflecting ongoing global economic trends and domestic factors. Understanding these rates and their fluctuations can help Filipinos navigate financial decisions that involve currency conversion.

What is the current dollar to Philippine peso exchange rate today at BPI?

As of today, the dollar to Philippine peso exchange rate at BPI is 57.23 PHP for 1 USD. Exchange rates may fluctuate throughout the day depending on market conditions.

Factors Influencing Exchange Rates

Several factors influence the exchange rates between the dollar and the Philippine peso. Key among these factors are:

- Economic Indicators: GDP growth rates, employment data, and inflation levels in both the U.S. and the Philippines can significantly alter currency values. A robust U.S. economy often strengthens the dollar.

- Interest Rates: Central banks adjust interest rates to control inflation and stabilize their currencies. Higher interest rates tend to attract foreign investment, boosting demand for that currency.

- Political Stability: Political events, such as elections or international agreements, can affect investor confidence and lead to changes in currency values.

- Global Market Trends: Trends in global oil prices, commodity prices, and trade balances can have direct effects on currency values.

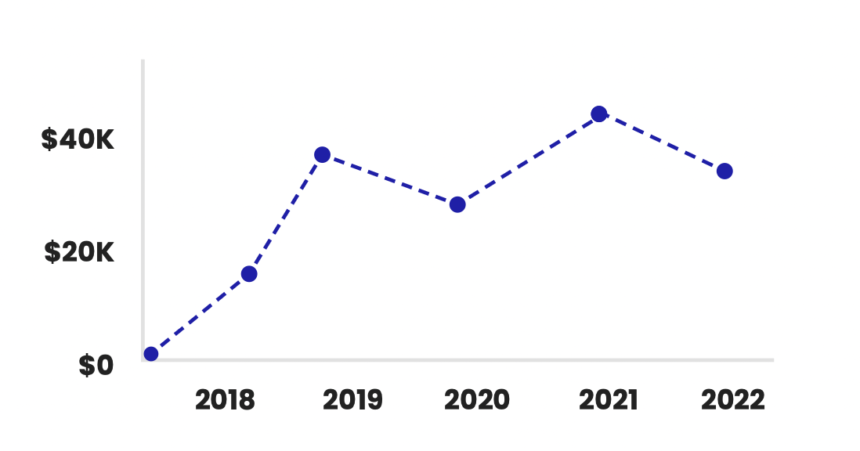

Exchange Rate Trends Over the Past Month

Analyzing the trends in the dollar to peso exchange rate over the past month provides insight into the current market environment. Below is a table illustrating the daily exchange rates for the month of October 2023:

| Date | Exchange Rate (USD to PHP) |

|---|---|

| Oct 1, 2023 | 56.80 |

| Oct 5, 2023 | 57.00 |

| Oct 10, 2023 | 57.15 |

| Oct 15, 2023 | 57.05 |

| Oct 20, 2023 | 57.23 |

| Oct 25, 2023 | 57.17 |

| Oct 30, 2023 | 57.23 |

From the data above, we observe a steady increase in the exchange rate, indicating that the dollar has gained strength against the peso. This trend may reflect ongoing economic recovery efforts and inflationary pressures in the Philippines.

Implications of the Exchange Rate on Filipinos

The exchange rate directly impacts several sectors of the Philippine economy.

- Remittances: A stronger dollar means that overseas Filipino workers (OFWs) sending money home will provide more pesos for their loved ones. With many families relying on these remittances, even slight variations in exchange rates can have significant effects.

- Import Costs: A higher dollar value makes imports more expensive. This situation can affect the prices of basic goods and services, leading to inflation and increased living costs for consumers.

- Travel and Tourism: For Filipinos planning to travel to the U.S. or for Americans visiting the Philippines, the exchange rate can either encourage or discourage travel. A favorable exchange rate for tourists can lead to increased spending and economic benefits for local businesses.

Long-term Strategies for Currency Exchange

To manage currency exchange efficiently, consider the following strategies:

- Monitor Exchange Rates: Regularly check the exchange rates using reliable financial platforms and news outlets to make informed decisions about currency conversion.

- Use Forward Contracts: If you are a business engaged in international trade, consider using forward contracts to hedge against unfavorable currency movements.

- Local Currency Accounts: For businesses, opening a local currency account can provide a buffer against currency fluctuations.

Conclusion

The dollar to Philippine peso exchange rate is more than just a number; it represents a complex interplay of international markets, economic conditions, and personal financial decisions. By staying informed on the current rates and underlying trends, individuals and businesses can make more strategic choices. Engaging with financial institutions like BPI can offer additional insights and tools to navigate these fluctuating rates effectively. Understanding the dynamics at play will ultimately empower consumers and businesses alike to make sound financial choices in a constantly changing economic environment.