Proposed House GOP Legislation Introduces Tax Cuts

As the budget discussions continue on Capitol Hill, a new Republican-backed bill has emerged, presenting several tax reduction proposals that could significantly affect countless Americans. On Wednesday, the House Ways and Means Committee endorsed a bill which seeks to make former President Trump’s 2017 tax cuts permanent and propose several new financial relief measures.

Impact of the Proposed Tax Cuts

The legislation aims to retain the current tax brackets that have been in place since 2018, thereby preventing tax increases that could affect more than 60% of filers in 2026, as indicated by a report from the Tax Foundation. The House Committee projects an average tax cut of approximately $1,300 for American taxpayers. Among the key features of the bill are:

| Tax Provision | Details |

|---|---|

| Senior Deduction | $4,000 deduction for seniors earning under $75,000 (single) or $150,000 (joint). |

| Standard Deduction Increase | Increase for singles from $15,000 to $16,000; heads of households from $22,500 to $24,000; married couples from $30,000 to $32,000. |

| Child Tax Credit | Extension of $2,000 credit, increased to $2,500 for 2025-2028. |

| Elimination of 1099-K Reporting | Abolishment of the requirement for payment platforms to report transactions under $600. |

| Pass-Through Deduction | Increase of deduction from 20% to 23% for small businesses. |

Legislative Process and Challenges Ahead

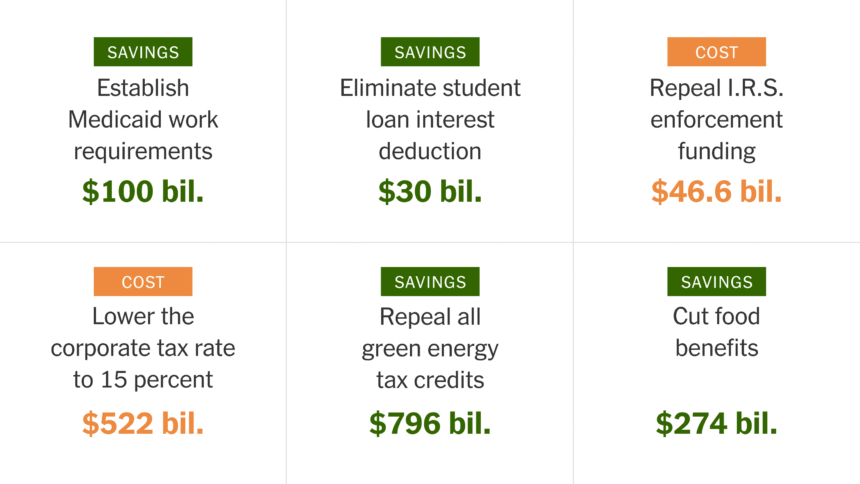

As the bill moves through Congress, changes are expected, with the goal of sending it to the Senate before Memorial Day. House Speaker Mike Johnson, a Louisiana Republican, is leading these efforts. However, the proposed cuts to essential programs like Medicaid and the Supplemental Nutrition Assistance Program (SNAP) are drawing fierce opposition from Democratic lawmakers. These cuts are part of a broader Republican strategy to secure $880 billion in savings for financing the tax cuts.

Critics, including Virginia Representative Don Beyer, have highlighted discrepancies within the bill. “They made provisions like addressing taxes on tips and overtime pay temporary, as opposed to the cuts for the richest 1%, which they made permanent,” Beyer remarked, voicing a key concern about the proposed legislation.

A Closer Look at the Benefits

Some highlights of the bill include:

- Standard deduction increases to provide taxpayers with greater tax relief.

- High-income exemptions for specific deductions aiming to foster equity.

- Continuance of tailored tax benefits for families with children and small business owners.

Although the proposed changes may present financial benefits to many, they also bring serious implications for social welfare programs, stirring debate among legislators.