House Republicans Advance New Tax Cuts in Budget Proposal

Updated: May 15, 2025

As discussions continue in Congress regarding the budget, a significant milestone was reached in the House with the approval of a Republican-sponsored bill that outlines an array of tax cuts. This legislation may bring both familiar and unexpected changes that could affect millions of American taxpayers.

Tax Cuts Overview

This past Wednesday, the House Ways and Means Committee officially endorsed a bill aiming to make the tax reductions established by the 2017 Tax Cuts and Jobs Act permanent. This move is pivotal as it is projected to shield over 60% of taxpayers from potential tax hikes scheduled for 2026 if no extensions are enacted, according to analyses from the nonpartisan Tax Foundation.

Moreover, the proposed bill suggests an average tax reduction of $1,300 for taxpayers, alongside various campaign-promised cuts, including changes favoring senior citizens and parents.

Key Tax Provisions in the Bill

As the bill navigates the legislative process, particularly with House Speaker Mike Johnson aiming for Senate consideration by Memorial Day, several noteworthy features stand out:

- New Deduction for Seniors: Individuals aged 65 and older may benefit from a new $4,000 deduction, available for those earning $75,000 or less (or $150,000 for married couples). This change is slated to be effective from the 2025 tax year through 2028.

- Increased Standard Deduction: The bill proposes to make the expanded standard deduction permanent, raising it to $16,000 for single filers, $24,000 for heads of households, and $32,000 for married couples. This adjustment would also apply starting the 2025 tax year.

- Extended Child Tax Credit: The Child Tax Credit would remain at $2,000, with plans to increase it to $2,500 initially for the 2025 tax year before reverting back in 2029.

- Removal of 1099-K Reporting Rule: A contentious rule requiring payment platforms to issue 1099-K forms for transactions over $600 would be eliminated, offering relief to many users.

- Increased Pass-Through Deduction: The pass-through deduction for small businesses would escalate from 20% to 23%, aiding partnerships and sole proprietorships.

- Overtime and Tip Tax Eliminations: Following promises made during his campaign, the bill seeks to remove taxes on overtime pay and tipped income, although these changes would be temporary, applying from 2025 to 2028.

- Vehicle Loan Interest Deduction: Taxpayers would be able to deduct up to $10,000 in interest paid on vehicle loans, contingent on the vehicle being manufactured in the U.S.

Projected Tax Relief Table

| Tax Provision | Current Status | Proposed Change |

|---|---|---|

| Standard Deduction | $15,000 | $16,000 |

| Child Tax Credit | $2,000 | $2,500 |

| Pass-Through Deduction | 20% | 23% |

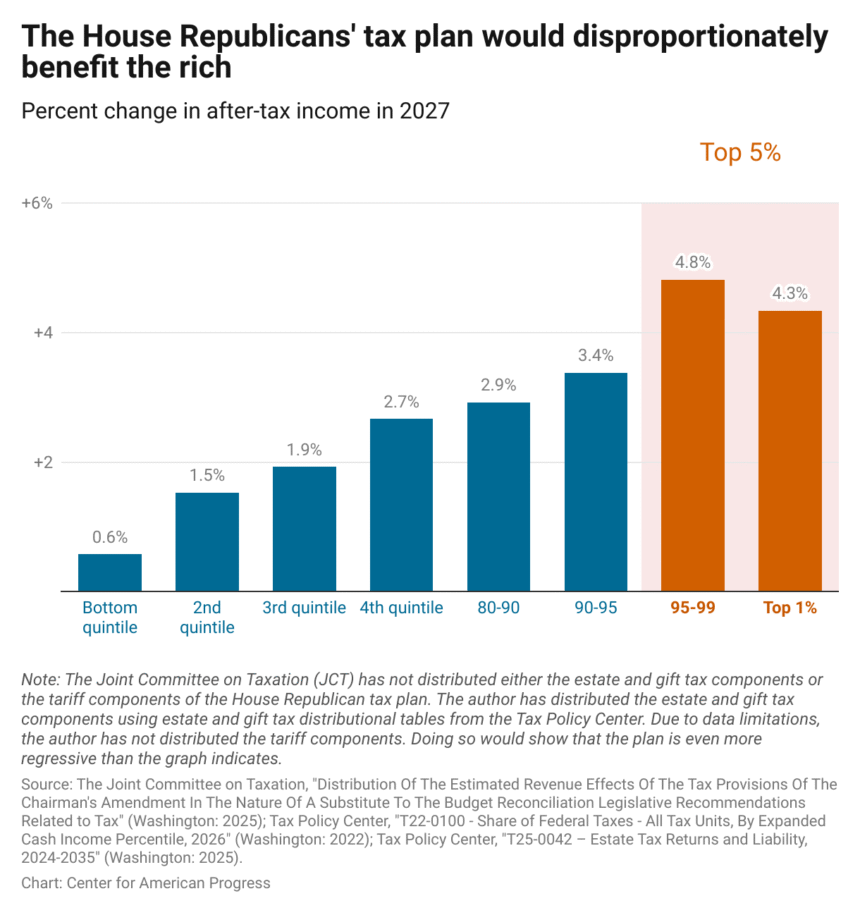

Despite the focus on these potential benefits, many Democratic lawmakers have raised concerns regarding the implications of proposed cuts to programs like Medicaid and SNAP, aiming to generate savings of $880 billion to finance the tax cuts. Critics argue that the temporary nature of some tax benefits contrasts sharply with the permanence of reductions benefiting the wealthiest individuals.

As the legislative journey continues, the evolving budget proposal remains a topic of intense discussion among lawmakers and constituents alike.